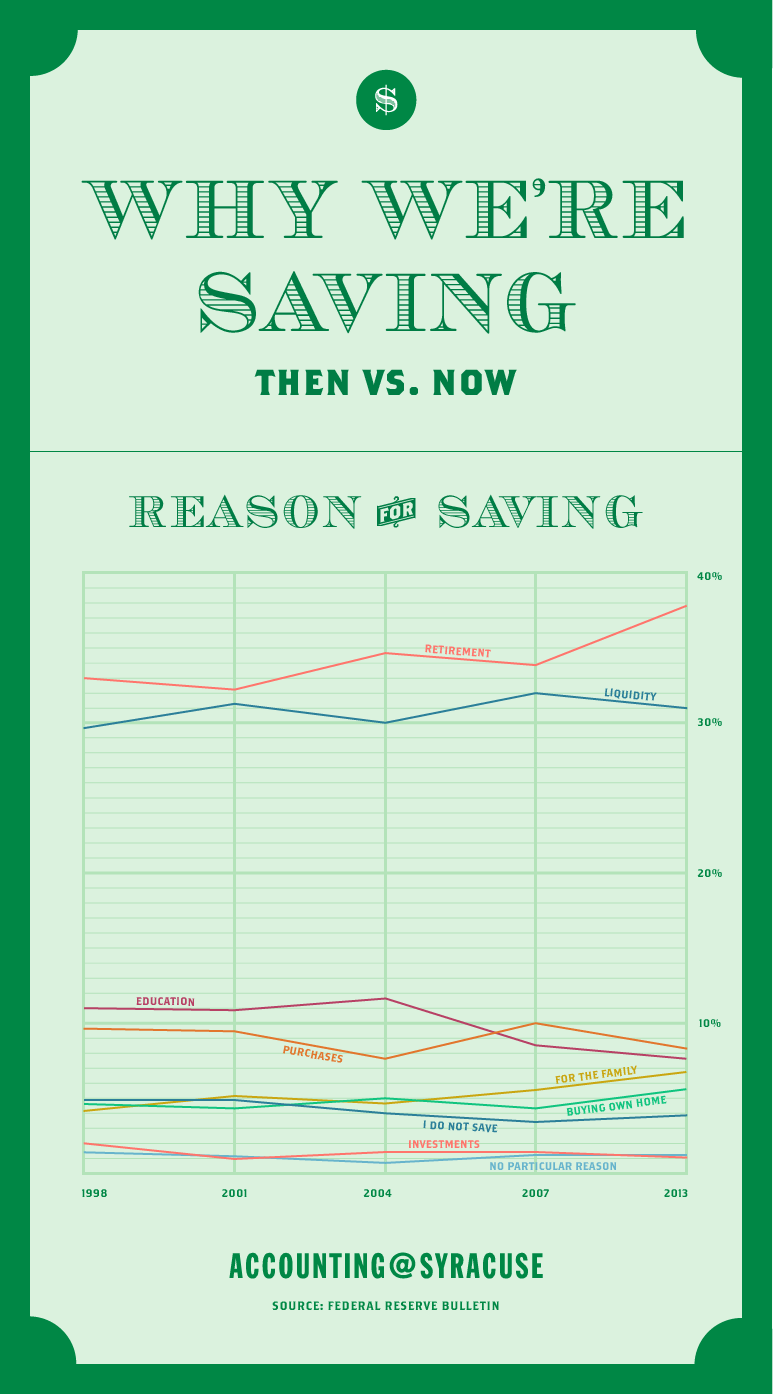

Why We’re Saving—Then vs. Now

Did you know people save more when they’re saving toward a goal? Knowing why you’re saving—as well as the timeframe in which you need to do it—are key to making sure that you stay on track to achieve your savings goals. Putting money away is important for a variety of reasons, including the ability to pay for education, buy a home, plan for retirement, care for a family and cover unexpected needs. However, the emphasis on those reasons changes over time, as noted in our graphic below.

There are a number of overall strategies to keep in mind when it comes to putting money away for a rainy day. Here are a few tips detailed by Forbes finance writer Colleen Oakley:

- Identify a specific endpoint. Researchers have found that the more specific the goal is, the better your chances are success. Dr. Joseph Kable, a neuroscientist and co-author of one study, told Forbes that uncertainty about when the end goal will arrive is a key factor in why people get sidetracked. “The best way to persist toward a big financial goal is to make the goal as concrete as possible,” he said.

- Create a specific plan for getting there. Instead of just having an awareness of the need to save, it’s important to know exactly how much you need and how long it will take to accumulate it. Experts say that taking the time to do the necessary calculations is critical to ensuring you have enough available if a need arises, and a financial planner can help you.

- Make it manageable. You know what they say about eating an elephant—just one bite at a time. When it comes to dealing with long-range goals, the same approach is needed. Instead of focusing on the 30-year total, focus on what you need to save this month to stay on track toward that specific endpoint. Research shows that you’ll save 78 percent more money by doing it.

- Evaluate your progress. In order to make sure you’re staying on track, it’s important that you evaluate your progress on a regular basis. This will give you the opportunity to see if adjustments need to be made and help you correct what isn’t working and replace it with something that will.

In addition to these general principles, the following tips from the U.S. Department of Labor will help you build up your retirement reserves:

- Get started and stick to your goals—it’s never too early or too late to bulk up your nest egg.

- Contribute to your employer’s retirement savings plan—which will lower your taxes and help you benefit from any employer match.

- Leave your retirement savings alone—making the most of compounding interest and avoiding penalties for early withdrawal.

- Contribute to an Individual Retirement Account (IRA)—which allows you to tuck away a minimum of $5,500 a year, and more if you’re over 50 years old.

In our graphic, you can see that individuals have a variety of reasons for putting money aside, and that the focus has changed over the years. Education was a major reason for saving almost 20 years ago, but that emphasis has dropped off quite a bit recently. However, saving for retirement has seen steady growth, as well as saving to cover family needs.

How about you? Are you saving, and if so, what are you saving for? Jump into the conversation with us by checking out our poll.