From Dorm Room to Living Room: Millennial Debt and Homeownership

Economists have long lamented the effect rising student loan debt could have on the larger economy, including homeownership. And now a new generation is hoping to move from the dorm room to their own living rooms. But how will millennials navigate the financial tension of paying off their student loans while taking on new homeownership debt?

Total student loan debt in the United States is $1.3 trillion, according to the New York Federal Reserve. The number nearly tripled from 2005 to 2015 and is now the second-largest category of debt after home mortgages. A U.S. Census Bureau study found that in 2013, 41 percent of young families had student debt, up from 17 percent in 1989.

Also growing: the number of millennials who live with their parents. The percentage of 18- to 34-year-olds living in their parents’ home grew from 26 percent to 34 percent in the decade ended in 2015, according to the Census Bureau. That’s about 23 million people, up from nearly 15 million in 1975.

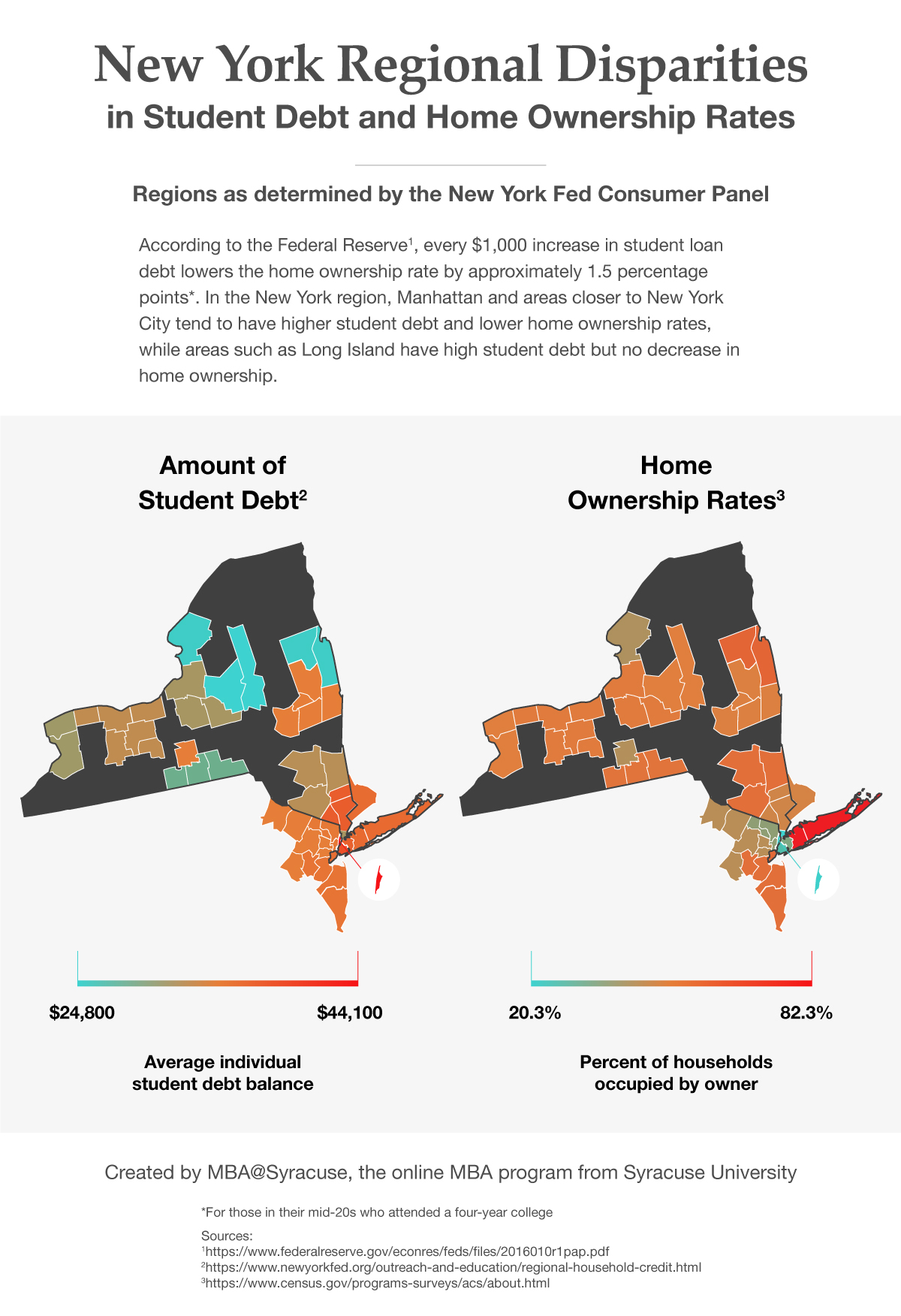

The Federal Reserve has estimated that every $1,000 increase in student loan debt lowers the home ownership rate by 1.5 percentage points for those in their mid-20s who attended a four-year college.

Christie Novak, an accounting professor at the Martin J. Whitman School of Management at Syracuse University, said it was tough for students and their parents to pay attention to, or calculate, the effect of a school loan on a student’s ability to get a home loan.

“I think when you’re going to school, it’s tough to think that far ahead,” she said. “Once you’re out of school, you’ve realized that you’ve taken on all this debt.”

In survey after survey, researchers have found that student loans are curtailing home buying.

That matters to the broader economy because new homeowners have to furnish a home and pay for electronics, cable or streaming service and utilities.

“Young adult households” have been a “key demographic in the nation’s housing bust,” according to a 2015 Pew Research Center study.

Go to a text version of New York Regional Disparities in Student Debt and Home Ownership Rates.

The largest generation

The Census Bureau defines millennials as those born between 1982 and 2000. In 2015, they edged out Baby Boomers to become the largest generation — more than 83 million people, representing one-quarter of the nation’s population. It’s a huge and diverse group, and the youngest members of the generation are still years away from thinking about home buying. But researchers see challenges ahead for them. The homeownership rate for 24- to 32-year-olds fell from 45 percent in 2005 to 36 percent in 2014, nearly twice as much as the 5 percentage point drop in homeownership for the overall population, the Federal Reserve said.

“Today’s young adults are less financially secure than their parents were at the same age,” said Tom Allison, with the millennial advocacy organization Young Invincibles.

He blamed the recession and macroeconomic factors, adding that those with college educations are doing better, while those who took out loans but never finished higher education are in the worst position.

“For the most part, college has never been more important and never been more expensive,” Allison said.

A 3 percent loan payoff

In late September, a home builder started trying to make it a little easier on former students by addressing the two trends. Eagle Home Mortgage, an affiliate of Lennar Corporation, offered to pay down student loans totaling up to 3 percent of the purchase price of a new home. It’s unique in the industry, said Doug Cropsey, senior vice president for secondary marketing for Lennar, a Fortune 500 company.

“Young people today are graduating with enormous amounts of school loan debt,” Cropsey said, making it more difficult to borrow money to buy a home.

Novak said the program was an acknowledgement “that there’s a trade-off between student loan debt and a mortgage.”

But she cautioned that borrowers have to be careful they’re not paying a higher interest rate or fees for loans of this type.

Cropsey said his company worked with Federal National Mortgage Association, or Fannie Mae, to make sure the program didn’t increase a home’s sale price or mortgage interest rate.

The program is “driving traffic to Lennar communities,” he said.

Not ready to settle down

Millennials are often criticized for living in their parents’ basement. But living at home is not a popular option. Only about one in four millennials in a recent survey said they would be willing to live with their parents for five years if it meant erasing their debt.

But many may not have much choice. A June report by the National Center for Education Statistics, which has been following high school sophomores for a decade, found that 23 percent were still living at home a decade later. They said student loan debt clearly affected their behavior, forcing them to work more than one job, work at a less desirable job, work for more hours or work in a job outside their field of study.

Allison, with Young Invincibles, said the aspirations of young adults are not about accumulating wealth. But he said they do want a home of their own.

Novak said other factors may be at work in the decrease of millennial homeownership. Millennials are also known for their “need to try out different things,” she said, whether “bouncing around jobs, bouncing around cities, I don’t think they’re ready to settle down.”

“If you have a place to stay and you’re comfortable staying there, and there’s no reason to move out,” she said, “why have your own home if you can stay with your parents for free or at a discounted price?”

Citation for this content: MBA@Syracuse, Syracuse University’s online MBA program