Potential Legalization of Recreational Marijuana Sales Poses Opportunity in NY

When investors begin testing the waters in the budding and potentially lucrative marijuana market, the dollars flow somewhat tentatively.

Marijuana is still illegal at the federal level, and despite the eight states that have legalized it for recreational use and the 29 that have legalized it for medical use, there’s a hovering uncertainty for investors — one aggravated recently when the Trump administration said it was calling for more aggressive enforcement of federal law.

So far, though, the feds haven’t cracked down in states where marijuana is legal, so any investor hesitation is mainly due to jitters — and a lingering reputation problem.

“There’s still a social stigma,” said John Torrens, professor of entrepreneurial practice at Syracuse University’s Martin J. Whitman School of Management. “Investors are always looking over their shoulders.”

Institutional investors have largely stayed away from the legal marijuana market, leaving only wealthy, risk-tolerant individuals or small groups of people who pool their funds and plunge in.

That’s what Torrens and a few friends and family members did three years ago, shortly after New York state legalized marijuana for medical use in 2014. The prospect of a huge return in the country’s fourth most populous state and elsewhere proved tempting. Arcview, a cannabis industry market research firm, projected legal cannabis sales would reach $10 billion in 2017, up more than 30 percent over 2016, and projected they will reach $24.5 billion by 2021.

But ultimately Torrens’ group decided against investing in New York and instead directed its dollars toward California marijuana growing and manufacturing operations. As it turns out, despite the massive potential upside in the Empire State, there were too many problems with the way New York decided to regulate and run its medical marijuana operations.

“We decided against the deal,” Torrens said, “because the law just wasn’t very strong.”

Torrens thinks the situation in New York could change, but for now the state’s laws are too restrictive for most investors. The state issued only five licenses, each allowing for five medical marijuana dispensaries, for a total of 25 locations. New York also requires each operation to be vertically integrated, which is a challenge for smaller investors.

“They have to cultivate, manufacture, do lab testing and dispense,” Torrens explained. “So, the problem New York has is it’s very expensive to start a new company and do all of those activities in the value chain.”

Another issue, analysts say, is that the state only allows a narrow range of patients access to medical marijuana, limiting the patient pool.

“From a patient access standpoint, there are a lot of diagnoses that aren’t on the ‘approved’ list.” Torrens said. “These companies had the licenses, they got fully integrated and then they only had 5,000 patients. They spent all this money and there was really no gain.”

The state still doesn’t allow sales of medical marijuana for smoking — only for vaping or ingesting.

New York’s approach to legalizing marijuana has been somewhat anemic, perhaps because Gov. Andrew Cuomo was anti-legalization as recently as last year, when he called marijuana a “gateway drug.” Lawmakers in Albany took his lead. But like other states, New York didn’t want to entirely pass up the potential tax revenue, either.

“I think the state was just really afraid to go down this road, and this was a way to dip their toe in the water,” Torrens said. “The next step is, obviously, full, adult-use recreation. I don’t know if New York will go that way, but other states are doing it and benefitting tremendously.”

Go to a text-only version of New York Could Be Earning Millions in Marijuana Tax Revenue.

But Colorado didn’t get it right at first, either. The state initially required vertical integration, but later eased up on that restriction after realizing it was too onerous for most operations and their backers.

“In my opinion, vertical integration isn’t necessary and doesn’t really achieve any function that served the general good of the industry or the public,” said Aaron Smith, executive director of the National Cannabis Industry Association.

He noted “a retail facility that sells beer shouldn’t be expected to produce the beer and grow the hops and barley.”

Colorado has also been at this the longest and has learned through trial and error. California, where the association is focusing much of its attention because of the massive potential in the country’s largest state, is just finding its footing. The state’s voters legalized recreational use in late 2016, having legalized medical marijuana use in 1996.

“Colorado is at the top because of the experience it’s had. Every legislative cycle they make tweaks to the law,” Smith said. “California is just getting started.”

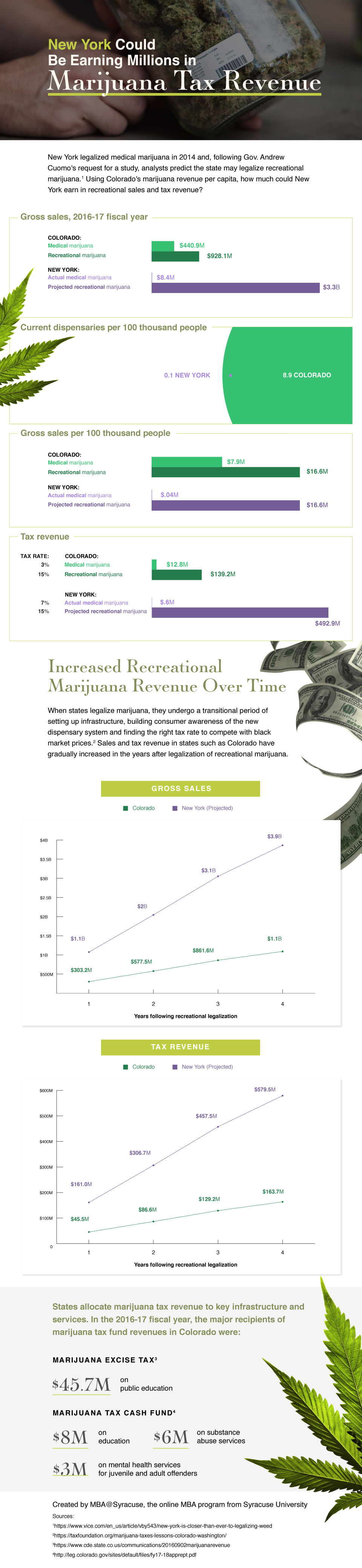

New York is even further behind and, proponents of full legalization say, missing out on the tax benefits, as well as the social and medical ones.

“Hundreds of millions of dollars of tax revenue is at stake,” Torrens said. “But there’s also the social benefits. Countless numbers of young, black men are incarcerated for petty crimes, and you have patients who could seriously benefit that just aren’t. There’s such a stigma attached to it that people who could get it, still aren’t. It’s still pot.”

But that could change. In January, Cuomo called for a panel to study legalizing recreational marijuana, a sign the state could soon contemplate full legalization — or a less restrictive law than it currently has.

This time, analysts hope, the state does it right.

“One, they should make it easier for patients to get their medicine, so they should open up the classifications,” Torrens said, referring to the list of approved diagnoses. “The next step is to make it legal for adult use and recreation.”

That, Torrens explained, would not only boost tax revenues, but save the state the cost of arresting, prosecuting and imprisoning people for low-level marijuana crimes.

At the same time, Torrens explained, state regulators need to be mindful that the five “incumbents” — that invested heavily in the state, despite the current law — aren’t punished if a flood of new investment flows in. It will be critical, Torrens said, to set rigorous standards for every entity in the value chain.

“Just allow a competitive process, and if you can meet the qualifications, go for it,” Torrens said. “Break up the value chain. There will be more innovation because you’ll find smaller, more nimble companies, rather than just five that don’t have any incentive to innovate.”

The state also needs to control what those in the legal marijuana trade call “diversion” — or illegal sales.

“The key is making sure there are incentives for compliance and getting into the legal system,” Smith said. “When there are barriers to entry, that leaves opportunities for a criminal market.”

“The states are laboratories of democracy and we’re proving that,” Smith added. “The goal, from the perspective of voters, is to undercut the criminal market as much as possible. That’s the intent of passing these modern marijuana laws.”

Citation for this content: MBA@Syracuse, Syracuse University’s online MBA program